June 24, 2014

Just

Because the Fed Is Doing the Right Thing Now Is No Guarantee It Will Continue

to Do So

The Fed is continuing to

slow the growth in the amount of credit it is creating. In December 2013, the

year-over-year growth in the sum of Fed outright holdings of securities and its

net repurchase agreements (repurchase

agreements minus reverse repurchase agreements) was 41.1%. As of May, the

year-over-year growth in this sum had slowed to 24.8%. At the same time that

growth in Fed credit creation has slowed, growth in commercial bank credit

creation has increased. In December 2013, year-over-year growth in the break-adjusted

commercial bank credit was 1.0%. As of May, year-over-year growth in

break-adjusted commercial bank credit had risen to 3.6%. In the five months

ended May, the compound annual growth rate (CAGR) of break-adjusted commercial

bank credit was 7.4%. For reference, the median year-over-year growth in

monthly observations of break-adjusted commercial bank credit in the past 38

years was 7.0%. As shown in Chart 1,

year-over-year growth in the sum of

Fed credit and break-adjusted commercial bank credit was 8.5% in May compared

to a 38-year median growth rate of 7.1%.

Chart 1

Chart 2 shows the

deviation between the year-over-year percent change in the sum of Fed and

adjusted commercial bank credit from 7.1%, the 38-year median of the

year-over-year percent change in this credit sum. As one can see, the

year-over-year percent change in the sum of Fed and bank credit had been “deficient”,

often severely so, relative to its median from March 2008 through June 2013,

with the exception of January 2010. But, as was stated above, in the 12 months

ended May 2014, annualized growth in the sum of Fed and break-adjusted

commercial bank credit was 8.5%, 150 basis points above its 38-year median

percent change. So, the “drought” in the sum of Fed and adjusted commercial

bank credit appears to have been broken with the combination of the resumption

of Fed net acquisitions of securities in September 2012 and the recent

acceleration in the growth of commercial bank credit.

Chart 2

As a “refresher”, the

reason I pay particular attention to this credit sum is that growth in a

variant of it has a strong association positive association with growth in

gross domestic purchases (defined as gross domestic product plus imports minus exports). The credit variant includes, in addition to Fed

credit and commercial bank credit, credit created by saving institutions and

credit unions. Commercial banks, saving institutions and credit unions issue

deposits that are redeemable at par. Thus, they are referred to as depository

institutions. So, my credit variant is the sum of Fed credit and depository

institution credit. As I have explained in previous commentaries, what

distinguishes this credit variant from other measures of credit is that credit

created by the Fed and depository institutions is credit created figuratively

out of “thin air.” As such, it enables its recipients (borrowers) to increase

their current spending while not requiring any other entity to pare back its

current spending.

Plotted in Chart 3 are the

year-over-year percent changes of quarterly observations in the sum of Fed and

depository institution credit along with gross domestic purchases from Q1:1954

through Q1:2014. When the percent changes in thin-air credit were advanced by

one quarter, a higher positive correlation (0.63) was obtained than with the

two series compared contemporaneously or with changes in gross domestic

purchases advanced by one quarter. This suggests that growth in thin-air credit

“causes” growth in gross domestic purchases rather than vice versa. Because gross domestic purchases include only purchases

of currently-produced goods and services, they do not capture spending or

transactions on other things that additional thin-air credit might finance, e.g.,

purchases of financial assets or previously-produced real assets. I would argue

that the correlation between changes in thin-air credit compared to total

transactions would be higher than its comparison to gross domestic purchases.

Regrettably, I am not aware of a series that measures total nominal

transactions.

Chart 3

After an

economically-depressing, not to mention, psychologically-depressing, severe

winter, the U.S. economy appears to be responding predictably to the relatively

rapid growth in thin-air credit. Chart 4 shows that both nominal retail

spending on goods and the real production of goods have rebounded in growth in

recent months. Chart 5 shows that growth in combined new and existing home

sales has come roaring back. Chart 6 shows that the least-revised labor market

data, the weekly state unemployment insurance benefit data, are indicating an

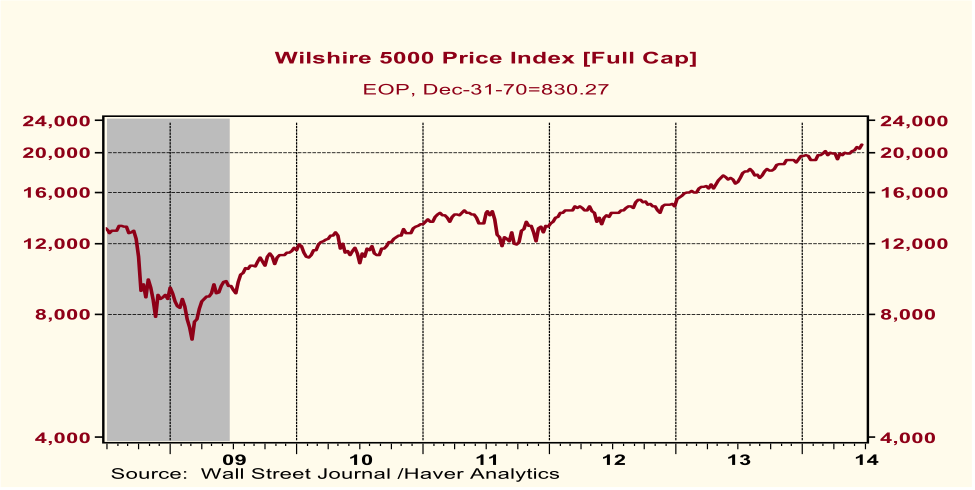

improved labor market environment. Chart 7 shows that U.S. equity prices

continue to climb. And Chart 8 shows that no matter how you slice it or dice

it, the rate of increase in consumer prices for goods and services is

accelerating.

Chart 4

Chart 5

Chart 6

Chart 7

Chart 8

The upshot of all this is

that unless the Fed wants to create an undesirable inflationary environment in

terms of asset prices and/or consumer prices of goods and services, it is time

for the Fed to scale back its creation of credit, which it has been in the

process of doing since the January 2014 commencement of its monthly tapering in

the net acquisition of securities. The Fed also has stepped up the amount of

its reverse-repurchase-agreement operations, which serve to reduce Fed credit,

all else the same.

But the Fed pursuing the

correct monetary policy today for reasons

it does not understand instills little confidence that it will continue to

pursue the correct policy tomorrow.

When the Fed announced in September 2012 that it was going to resume its net

acquisitions of securities, it did not

say that it was doing so in order to boost the then anemic growth in thin-air

credit. No, it justified the resumption of net acquisitions of securities in

terms of lowering the yields on longer-maturity securities. The Fed never

publicly explained how it decided that $85 billion of net securities acquisitions

per month was the correct amount. Nor did it publicly explain why the $10

billion tapering of net securities acquisitions per FOMC meeting was the

correct amount. The Fed continues to be obsessed with the price of credit, an interest rate, rather than the quantity of credit. Moreover, on those

rare occasions when the Fed might mention the quantity of credit, it has never

made a distinction between thin-air credit and all other credit. But then,

neither have many other economic commentators, save for those of the Austrian

School.

Let’s make some

assumptions to give us an idea as to the likely behavior of thin-air credit

over the next year and a half. Assume

that the Fed continues to taper its net acquisitions of securities by $10

billion per FOMC meeting, implying that by the December 2014 meeting, it would

be making no net new outright acquisitions of securities to its balance sheet. Assume that the Fed maintains the amount of

its net repurchase agreements at a level equal to that of the average of the

first five months of 2014, $245.9 billion. Lastly, assume that break-adjusted

commercial bank credit continues to change at a CAGR of 7.4%, its annualized

growth rate in the five months ended May 2014. Chart 9 shows the actual

year-over-year percent changes in monthly observations of the sum of Fed and

break-adjusted commercial bank credit from December 2008 through May 2014 as

well as projected values through December 2015 based on the above assumptions.

Chart 9

At the end of 2013, this

credit sum had increased by 9.2% vs. December 2012, primarily because of the

Fed’s securities purchases. As of this past May, the year-over-year growth in

this credit sum had moderated to 8.5% because of the Fed’s tapering of its

securities purchases. If my assumptions regarding Fed and bank credit hold,

then by December 2014, the sum of Fed and bank credit growth would have

moderated further to 8.0% on a year-over-year basis.

Let’s pause here to

contemplate what this would imply for the pace of economic activity and the

behavior of financial markets. Back-to-back years of growth in the sum of Fed

and bank credit of 9.2% and 8.0% represents robust growth in this variant of

thin-air credit. After the weather-depressed first quarter of this year, I

would be expecting a strong rebound in the pace of real economic activity over

the remaining three quarters of 2014. I also would expect a continued modest

upward trend in the growth of consumer prices for goods and services. If this

relatively robust growth in nominal

economic activity were to occur, it would create expectations of financial

market participants that the Fed would start to raise its policy interest rates

sooner than what the Fed is

projecting. Thus, yields on Treasury securities from maturities of two years on

out, would move higher over the remaining course of 2014. Although the stronger

growth in nominal economic activity would be a plus for corporate profits, the

rise in interest rates would represent a higher discount factor applied to

corporate profits. Thus, although U.S. equity prices could continue to move

higher in 2014, the rise in market interest rates would represent a headwind

for equity prices.

But if my projections for

growth in thin-air credit for 2015 are close to the mark, 2015 would be a more

challenging year for real economic growth and the equity market. Slowing from

8.0% to 5.5% in thin-air credit growth would represent a significant deceleration.

Depending on how the Fed reacts early in 2015 to stronger real growth and

higher consumer price inflation in 2014 than it expected, even 5.5% growth in

thin-air credit in 2015 might be hard to achieve. If things play out the way I

expect in 2014, Fed hawks’ influence on monetary policy decisions would

increase in early 2015. Thus, Fed interest rate hikes could come early in 2015.

All else the same, these rate hikes would act as a brake on commercial bank

credit creation. Thus, the 2015 7.44% CAGR in bank credit assumed in my

projection could be too high, which, in turn, would render the assumed 5.5%

growth in the sum of Fed and bank credit too high.

As I indicated at the

outset, the slowing in Fed credit creation in 2014 seems entirely prudent to

me. But I would have a lot more confidence in the correctness of Fed policy in subsequent years if I believed the Fed understood

why it is correct to slow its credit creation in 2014. Without this

understanding, there is a high likelihood of significant Fed policy mistakes in

subsequent years.

I want to close on a note

of personal humility. (As my brother, may he rest in peace, used to remind me,

I have so much to be humble about.) In my projections of thin-air credit

growth, I have made assumptions about Fed credit growth and commercial bank

credit growth. I feel most confident about Fed credit growth and least

confident about bank credit growth. After all, my assumption of 7.44% CAGR in

bank credit going forward is nothing but the simplistic assumption that what

happened in the past 5 months will persist in the next 19 months. Thus, the

outlook for thin-air credit growth could change significantly in the weeks and

months ahead. That is why every Friday afternoon I update my spreadsheet on it.

If things do change significantly from what I have assumed here, I will alert

you to this.

Paul L. Kasriel

Econtrarian, LLC

Senior Economic and

Investment Adviser

Legacy Private Trust Co.

of Neenah, WI

1 920 818 0236